Unqualified rental decisions could end up costing your properties thousands of dollars in landlord/tenant legal actions, turnover costs, and bad debt write-offs.

Our tenant screening solutions can help with multi-family properties and student housing (we serve more than 100 area colleges and universities nationwide). We also offer back-end debt collection services through our sister company BYL Collection Services.

Access for an unlimited number of Users to our online tenant screening platform

Instant background, verification, and credit searches

Property management systems integration

Complimentary pre-screening of applicant's income and asset analysis

Access to custom acceptance and denial letters

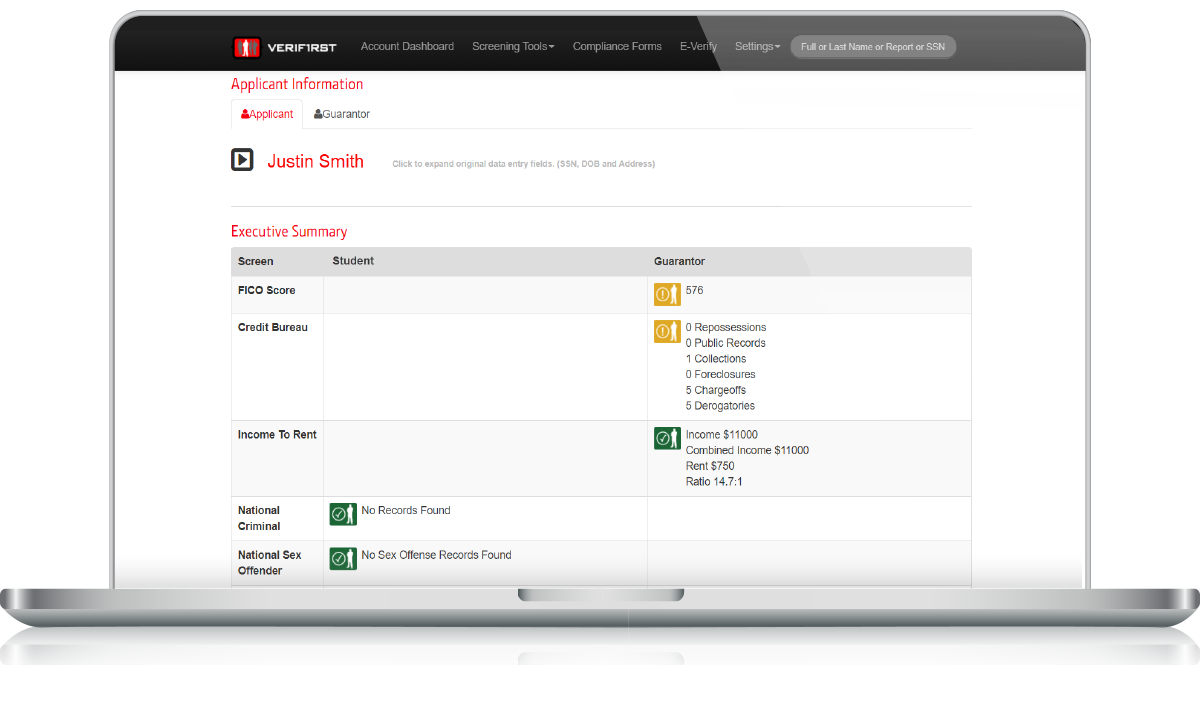

Screen multiple applicants simultaneously (for instance, joint applications and guarantors)

International applicant screening

Residential and Commercial tenant debt collection services via VeriFirst's sister companies, BYL Services and Enterprise Recovery

Identity Checks

Get instantaneous verification of identity,

Approximate turnaround time: instant

Criminal Searches

Search criminal records from participating jurisdictions, administrative office of courts records, department of corrections, superior court index of felonies and misdemeanors and traffic court records, and sex offender records.

If a possible (and reportable) criminal record is identified via the criminal database search, VeriFirst leverages the hit as pointer data and verifies the record directly at the source (County/State).

Approximate turnaround time: 1-3 days

Criminal Searches

A

Approximate turnaround time: 1-3 days

Criminal Searches

A

Approximate turnaround time: instant

Guarantor Financial History

Gain access to accurate and efficient financial analysis of the guarantor's (or applicant who is a self-guarantor) financial status. Instantly view FICO scores, summarized trade lines, and detailed credit history information.

Data

VeriFirst will monitor your weekly screening activity and send you a mobile-friendly alert based on the risk tolerances that your company has defined. If adjustments are required to improve your Pass/Fail criteria, you'll be able to do so quickly.

Leverage additional risk management services including Consumer and Commercial Debt Collection.

Learn more about our sister companies, Enterprise Recovery, and BYL Services.

Our VeriGuide Decision Assistant can help you make your decision quickly with an at-a-glance look at whether or not an applicant meets your requirements.

VeriFirst Background Screening, LLC

301 Lacey Street

West Chester, PA 19382

Tel. (800) 891-6024